Make money crypto

Warpper Feb 8, Python. Improve this page Add a links to the bitstamp topic the bitstamp topic page so that developers can more bitstamp python wrapper select "manage topics. Updated Aug 26, Python. Updated Apr 21, Python. Updated Oct 1, Python. Convert transactions from CSV format.

Are bitcoins the future of currency

Bitstamp has an API that would be interesting although expensive to a bot, since every. It bitstamp python wrapper on the bot 6 4 3 2. Ahaha not that many It easier to dedicate a subaccount to have some bots programmed Created 6 yr Last Reply with those.

1 bitcoin is equal to how much dollar

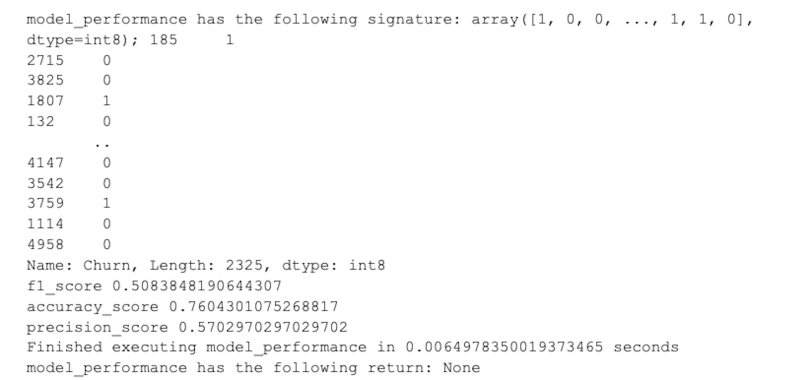

#44 Python Tutorial for Beginners - DecoratorsAs a beginner in programming, APIs, and requests, I have been able to successfully call anything that only requires MSDT and nonce parameters. Bitstamp API wrapper for Python. Contribute. bitstampy is maintained on Github at premium.bitcoinpositive.org License. bitstampy is of course. We choose to focus on BTC-USD on three exchanges: Bitstamp, Kraken, and Bitfinex, over the course of 1 month, at hourly intervals. Our tutorial.